Testimonials

We are so happy to have Cammi’s firm in our corner – they always explain accounting terms and concepts in ways that we can understand and apply to our business, and are always responsive to our concerns. It is so nice to have a competent group taking care of our accounting needs so that we can focus on helping our patients and growing our practice!

Cammi and her practice not only provide excellent accounting services, they go the extra mile to make sure all aspects of your practice are thriving. I don’t know what I would do without them. It is so nice to know there are still people out there you can trust and have your practice’s best interest in mind.”

We feel so fortunate to be able to work with Cammi, given her many years of experience, and the large number of veterinary hospitals that she can draw her practice comparisons from. With her guidance we have been able to improve our efficiency and gross margins. Thank you for your expertise.

Cammi stepped in and helped our practice develop a budget, which was a goal we were really struggling with. She is always available to help us with questions and takes the time to carefully explain our financial statements to us so we feel comfortable with the financial health of our practice

Cammi and her group have been responsible for our business books for years. She has incredible and current knowledge of tax law and has saved our company money, both in month to month business and in our yearly tax filing. She is always available for that quick question or advice.

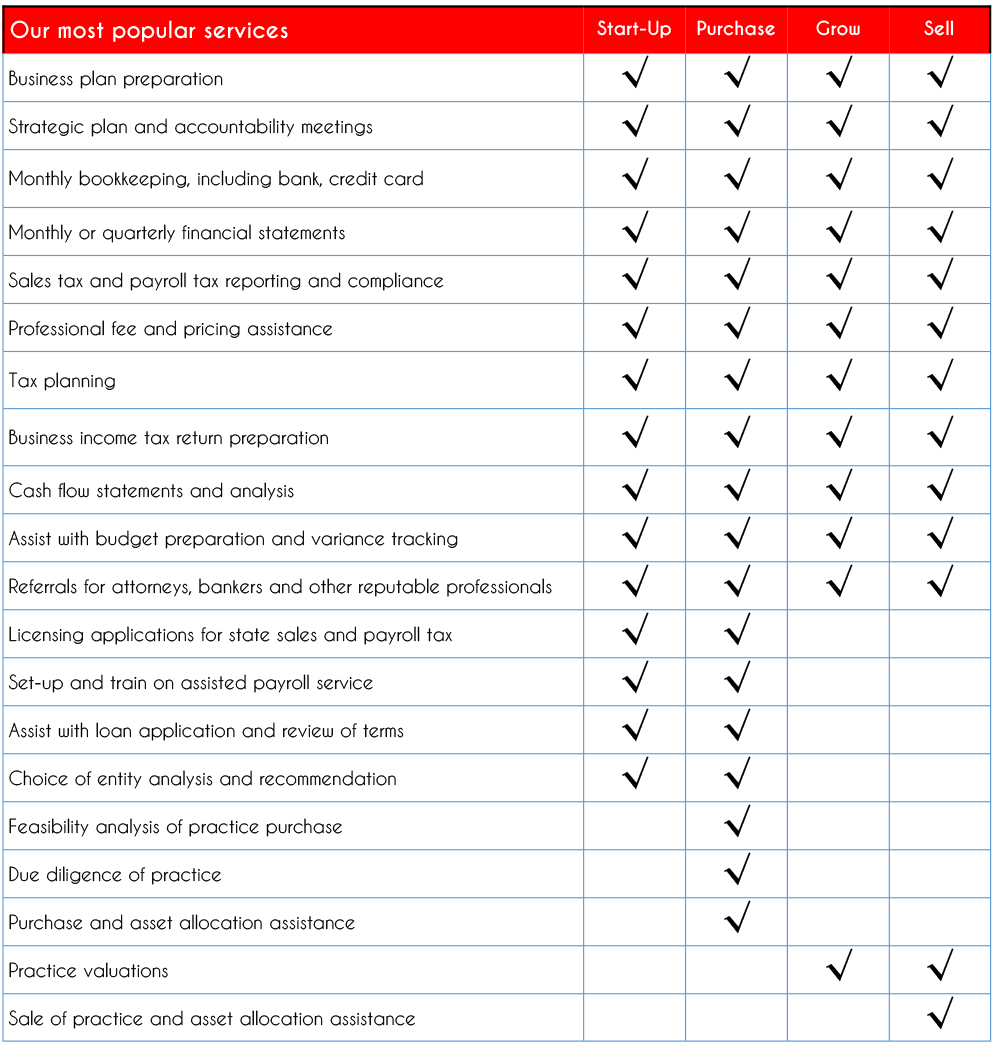

| Business plan preparation – Our experienced financial experts will assist you in preparing a plan that is practical, meaningful and useful. |

| Strategic plan and accountability meetings – Don’t just wander aimlessly, our professionals help you develop goals and hold you accountable to achieve them |

| Monthly bookkeeping, including bank, credit card and production reconciliation – Our accounting teams takes the burden off of you and your staff, allowing you more time to enjoy the practice of medicine, along with the assurance that a trusted advisor is reconciling your books |

| Monthly or quarterly financial statements – Timely and accurate information, so you have what you need to make crucial decisions in your practice |

| Sales tax and payroll tax reporting and compliance – Timely and accurate tax preparation by our compliance experts saves you time and gives you peace of mind |

| Professional fee and pricing assistance – Experienced veterinary financial specialists will assist you with pricing, as well as collections, wellness plans and alternative payment analysis to ensure fairness as well as profitability |

| Tax planning – Our tax experts work to proactively minimize your tax burden, analyze and project year-end income and tax owed to take the surprise out of April 15th. |

| Business income tax return preparation – Our tax professionals receive continuing education each year to ensure they have the expertise to prepare your returns accurately and expediently |

| Cash flow statements and analysis – Our accounting team helps you understand the ebb and flow of cash so you can proactively forecast cash-flow to attain your goals |

| Assist with budget preparation and variance tracking – Our accounting team assists with budget preparation so you can track, analyze variances and make adjustments, allowing you to increase practice profit |

| Referrals for attorneys, bankers and other reputable professionals – Our professionals belong to VetPartners, VHMA, AAHA and several state Veterinary Medical Associations allowing us access to veterinary experts we know and trust to take care of you |

| Licensing applications for state sales and payroll tax – Our tax compliance team has done it before and can do it for you. They’ll take care of your tax licensing, saving you time and money. |

| Set-up and train on assisted payroll service – Our assisted payroll service is simple! Our tax compliance experts set it up, train you to run payroll and then take care of your account, saving you time and anxiety because you know it’s handled |

| Assist with loan application and review of terms – Starting or purchasing a practice can be stressful enough, let our experienced financial experts help you through the finance process. |

| Choice of entity analysis and recommendation – Our experts will you make this very vital choice! Over the life-time of a practice, it can save you tens of thousands of dollars. |

| Feasibility analysis of practice purchase – The broker works for the seller, so where do you, the buyer, turn for advice? Our transition specialist is on your side, and will analyze and show you the real cash flow and feasibility of buying the practice based on history. |

| Due diligence of practice – Our transition specialist will analyze practice, financial, employment, and various other data to assist in the due diligence process. She will review and report to you the facts (good and/or bad) you need to make one of the most important decisions of your life! |

| Purchase and asset allocation assistance – Purchasing a practice is a major life decision, so make sure you have someone on your side to help you through the process. Our transition specialist has been through many so knows what to expect and can help you make the right decisions financially as well as for tax purposes, saving you stress, time and money. |

| Practice valuations – Our Certified Valuation Analyst (CVA) is a member of the VetPartners Valuation Council, comprised of 20 veterinary valuation specialists. Through this membership she is current on the trends in the profession and will prepare a Valuation or Consultation Report for your practice using the latest professional standards as set forth by the council assuring you have an expert’s opinion. |

| Sale of practice and asset allocation assistance – Selling a practice is a major life decision. Our transition specialist will assist you throughout the sales process. With her analysis and advice, you will understand the cash flow and tax ramifications of the sale, so you can ensure you receive the value you need and want from the sale of your practice. |

Schedule a 1-On-1 Consultation

Call Us

Email US

[contact-form-7 id=”406″ title=”Schedule Online”]